The Securities and Exchange Board of India (SEBI) has approved the proposed initial public offering (IPO) of Bajaj Housing Finance, 100% owned housing finance subsidiary of Bajaj Finance. Bajaj Housing Finance filed its draft red herring prospectus (DRHP) with SEBI in June For ₹7,000 crore IPO.

The IPO will contain fresh issue and offer-for-sale (OFS) both. It includes worth up to ₹4,000 crore for fresh issue and up to ₹3,000 crore for offer-for-sale (OFS). Bajaj Finance is the only promoter which is selling shares in OFS. The proceeds from the fresh issue will be used to strengthen Bajaj Housing Finance’s capital base. It allows the company to meet future business requirements for onward lending.

The book-running lead managers of this IPO are SBI Capital Markets, IIFL Securities, BofA Securities India, Kotak Mahindra Capital, Goldman Sachs (India) Securities, Axis Capital, and JM Financial.

The share sale is being conducted in order to meet with Reserve Bank of India (RBI) regulations, which require upper-layer non-banking financial companies to be listed on stock exchanges by September 2025. This regulatory requirement seeks to enhance transparency and governance in the financial sector.

Bajaj Housing Finance Limited (BHFL) provides financing for the purchase and renovation of residential and commercial real estate. It is Headquartered in Pune. In addition, the company offers developer financing, working capital for business expansion, and loans secured by real estate. CRISIL and India Ratings have assigned the company a long-term debt rating of AAA/Stable and a short-term debt rating of A1+.

Bajaj Housing Finance Limited (BHFL) provides financing for the purchase and renovation of residential and commercial real estate. It is Headquartered in Pune. In addition, the company offers developer financing, working capital for business expansion, and loans secured by real estate. CRISIL and India Ratings have assigned the company a long-term debt rating of AAA/Stable and a short-term debt rating of A1+.

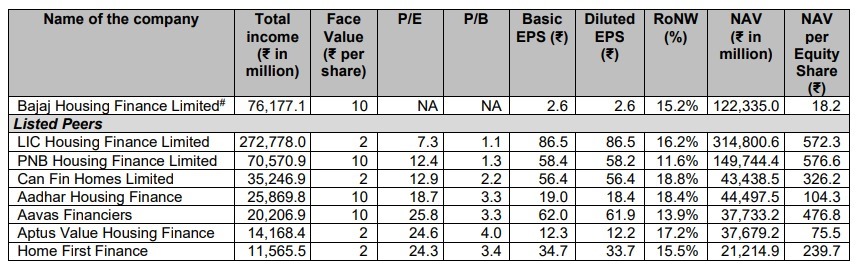

In the first quarter of FY25, Bajaj Housing Finance reported a net profit of ₹483 crore, up 5% year on year. By the end of June, the company’s assets under management had increased to ₹97,071 crore. According to the portfolio breakdown, secured loans make up 10%, home loans make up 57%, dealer financing makes up 11%, and lease rental discounting makes up 20%.

The lender disbursed ₹12,004 crore over a network of 174 locations during the quarter. The ratio of gross non-performing assets (NPAs) was 0.28% until June 30, while the ratio of net NPAs was 0.11%. These numbers represent a minor increase over the 0.23% and 0.08% ratios from the previous year.